- calendar_month September 7, 2023

Sharing Tags

California, ChatGPT, Housing Market, Real Estate 2023, Real Estate News, Real Estate Tips, Southern California

Blog Written By ChatGPT

The California real estate market is constantly evolving, and staying informed about its current status is crucial, especially if you're considering buying or selling a property. In this blog, we'll provide an in-depth analysis of the state of the California real estate market, including key factors such as home prices, interest rates, fire insurance, and other variables that could impact housing in the next 12-18 months.

- Home Prices

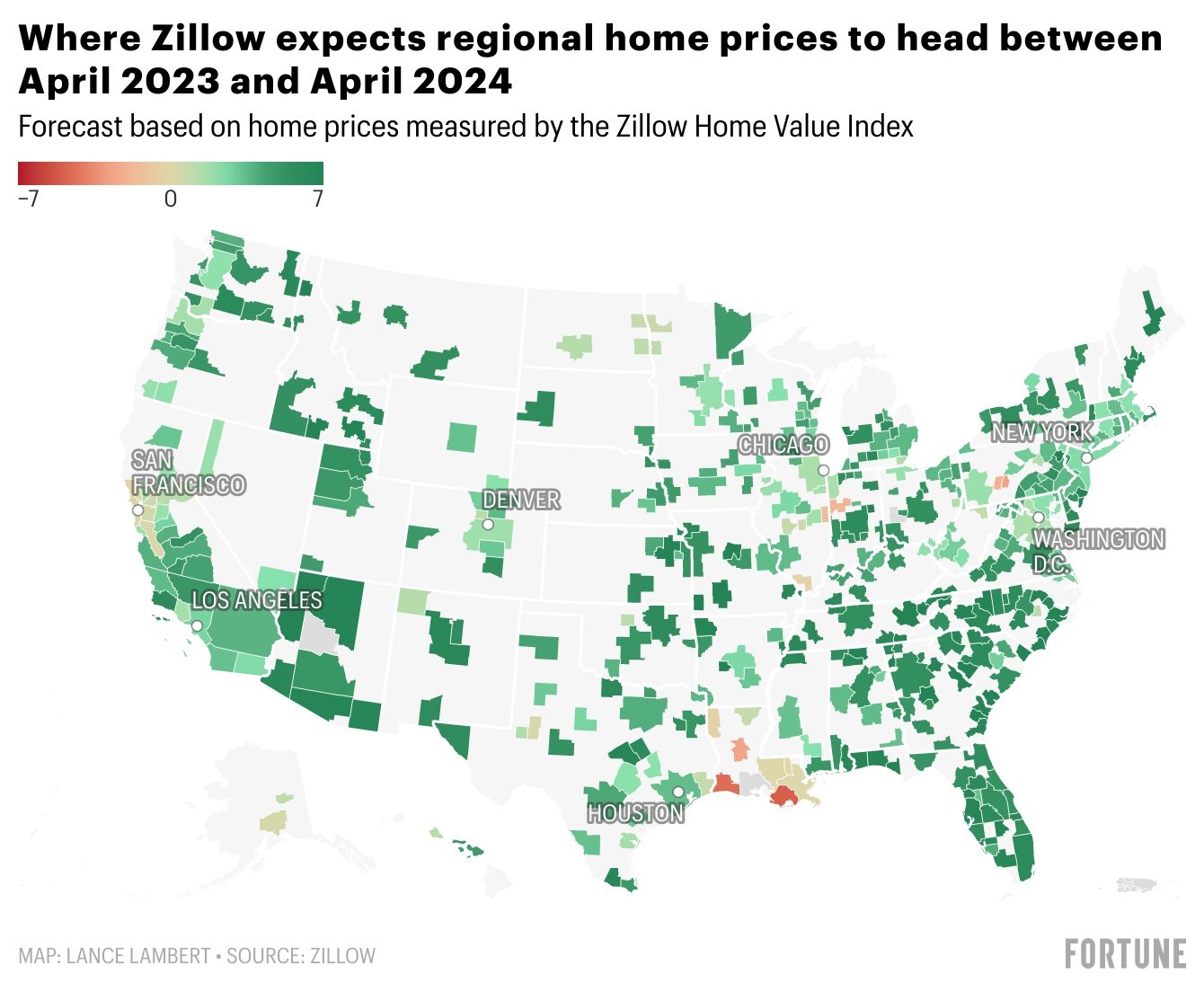

Home prices in California have seen a steady increase over the past several years, and this trend is expected to continue in the near future. The demand for housing remains high, driven by factors such as population growth, a strong job market, and low housing inventory. Additionally, the pandemic has fueled a desire for larger living spaces, which has contributed to the rise in home prices.

In the next 12-18 months, homebuyers can expect to face competitive bidding situations and potentially escalating prices. It's essential to work closely with a real estate agent who understands the local market to help you navigate these challenges and make informed decisions.

- Interest Rates

Interest rates are a significant factor affecting the California real estate market. Historically low mortgage rates have made homeownership more accessible, and they've played a vital role in driving demand. However, experts predict that interest rates may gradually increase in the coming months.

If you're considering buying a home in California, it's essential to keep a close eye on interest rate trends. Locking in a low mortgage rate now could save you thousands of dollars over the life of your loan. Consult with a mortgage expert to explore your financing options and secure the best rate possible.

- Fire Insurance

California has faced its fair share of wildfires in recent years, making fire insurance a crucial consideration for homeowners. Insurance companies have become more selective about offering coverage in high-risk fire areas, and premiums have increased.

In the next 12-18 months, homeowners should anticipate potential changes in fire insurance policies and premiums. It's essential to evaluate the wildfire risk in your desired area and work with an insurance agent who specializes in California's unique challenges to ensure you have adequate coverage.

- Other Variables

Several other variables could impact the California real estate market in the near future:

a. Supply and Demand: The ongoing supply shortage of homes in California will likely continue to drive competition among buyers and contribute to rising prices.

b. Government Policies: Keep an eye on any legislative changes that could impact housing, such as zoning regulations, tax policies, or housing assistance programs.

c. Economic Factors: Economic conditions, including job growth and inflation, can influence the real estate market. A strong economy can bolster demand for housing.

d. Environmental Concerns: Climate change and the threat of natural disasters may affect long-term property values and insurance costs.

Conclusion

The California real estate market is poised to remain competitive and dynamic in the next 12-18 months. Homebuyers and sellers must stay informed about home prices, interest rates, fire insurance, and other variables that could affect their real estate transactions.

Working with a knowledgeable real estate agent, mortgage expert, and insurance professional is essential for making well-informed decisions in this ever-changing market. By staying proactive and adaptable, you can navigate the California real estate market successfully and achieve your homeownership goals. Contact me today to create your real estate plan going into 2024!