- calendar_month April 14, 2022

- folder Real Estate News

https://www.cnn.com/2022/04/14/tech/elon-musk-twitter-offer/index.html

By Chris Isidore and Mark Thompson, CNN Business

Updated 4:52 PM ET, Thu April 14, 2022

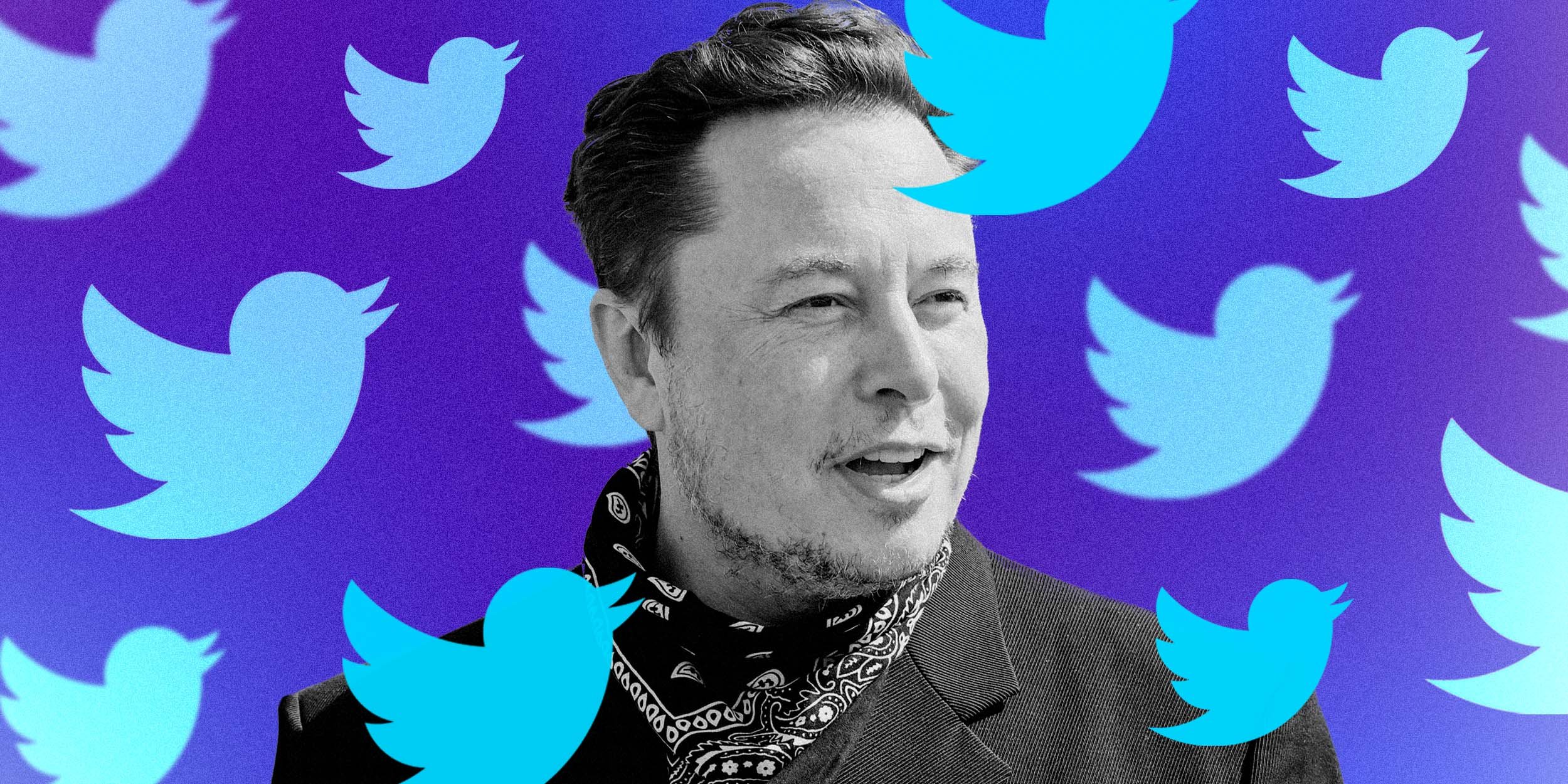

New York/London (CNN Business)Elon Musk has made an offer to buy Twitter (TWTR) and take it private, saying he believes the company needs to be "transformed."

According to an SEC filing, Musk has offered to acquire all the shares in Twitter he does not own for $54.20 per share, valuing the company at $41.4 billion. That represents a 38% premium over the closing price on April 1, the last trading day before Musk disclosed that he had become Twitter's biggest shareholder, and an 18% premium over its closing price Wednesday.

Musk said the cash offer was his "best and final offer," according to the SEC filing, adding that if it's not accepted he would have to reconsider his position as a shareholder.

The Tesla CEO sent an offer letter to the company Wednesday night, according to the filing.

"I invested in Twitter as I believe in its potential to be the platform for free speech around the globe, and I believe free speech is a societal imperative for a functioning democracy," he said in the letter to Twitter. "However, since making my investment I now realize the company will neither thrive nor serve this societal imperative in its current form. Twitter needs to be transformed as a private company."

The letter was addressed to Bret Taylor, the chair of the Twitter board, not CEO Parag Agrawal, who assumed that title last fall. It concludes: "Twitter has extraordinary potential. I will unlock it."

Twitter issued a statement Thursday confirming that it had received the offer. The company said its board would carefully review the proposal "to determine the course of action that it believes is in the best interest of the company and all Twitter stockholders." Twitter declined to comment as to when its board would meet to discuss the offer.

Shares of Twitter (TWTR) shot up as much as 13% in premarket trading on the offer Thursday, but soon retreated and were trading up about 5% at the market open. They were little changed at midday and slipped into negative territory, suggesting that investors had doubts the offer will be accepted.

But it will be difficult for Twitter to reject Musk's bid at the price he is offering, said Dan Ives, tech analyst with Wedbush Securities.

"Musk is putting the Twitter board's backs against the wall," Ives said. "The premium is at a level that will be hard to see other bids occurring."

But to get a return on a bid this high, Twitter would need to do more to bring in subscriber revenue and cut costs, Ives said. Musk's commitment to use the company to promote greater free speech doesn't do much, if anything, to increase its profitability, Ives said.

"Musk making this about free speech is the exact opposite of what every other corporate raider would do about monetizing the company's value," he added. "It's historic and bizarre at the same time."

Musk has 81.6 million Twitter followers, far more than any other other CEO, and is a much more prolific tweeter than the handful of celebrities who have even more followers than he does.

Musk a frequent critic of Twitter

While other critics of Twitter complain the social media platform has not done enough to control the spread of misinformation, Musk has expressed more concern about efforts to limit what users are allowed to tweet. Last month he said he was giving "serious thought" to creating a new social media platform.

"Given that Twitter serves as the de facto public town square, failing to adhere to free speech principles fundamentally undermines democracy," Musk tweeted last month. "What should be done?"

Last week, Musk disclosed he had been buying shares of Twitter since late January, and that he had spent $2.6 billion to accumulate 73.1 million shares, which at the time represented a 9.1% stake, according to what the company had disclosed at that point about the number of shares that are held by investors.

In February, Twitter announced a plan to repurchase $2 billion worth of shares in an effort to raise its stock price. It has since repurchased 37 million shares, according to a disclosure filing on Thursday, reducing the number of shares outstanding by that amount.

That reduction in total shares increased Musk's stake to 9.6% without him having to purchase even one additional share. And it reduced the total value of the company by $2 billion based on Musk's $54.20 offer price.

After Musk's stock purchase disclosure, he initially accepted an offer of a seat on the board, an agreement that included a cap on his total investment in the company at 14.9%.

But just days later, on Sunday, Agrawal disclosed that Musk had decided not to join the board, thus removing that limit on his ownership.

Musk's investment in Twitter, and the original announcement that he would take a position on its board of directors, stirred concerns among some employees who did not want to be associated with the often controversial executive.

Agrawal sent a memo to employees Thursday announcing that there would be a company-wide meeting Thursday afternoon to "discuss today's news and what's next."

"It's important that we all come together today as #OneTeam," he said in the brief notice of the meeting."

Musk ha been unusually silent on his plans for Twitter in the days since he declined the spot on Twiter's board. He has yet to spell out the specifics of what changes he wants at the company.

"Right now there's more questions than answers as to his next step," said Ives.

How Musk could pay for his purchase

Musk did not disclose how he intends to fund his purchase. He said he has hired Wall Street giant Morgan Stanley (MS)as his financial advisor for the transaction.

Although Musk is the richest person on Earth, most of his $274 billion net worth is tied up in his holdings in the publicly-traded stock of Tesla and privately-held SpaceX, and he has been reluctant to sell shares of Tesla beyond what he needed to in order to pay taxes.

Shares of Tesla (TSLA) slipped 3% in early trading Thursday, perhaps on fears that Musk would sell shares in order to raise cash, or that he could be distracted from his duties at Tesla by his latest interest in Twitter.

It's very possible that Musk won't need to sell Tesla shares and instead could use them as collateral to borrow the money he needs to buy Twitter, Ives said. Musk's Tesla shares are worth about $177 billion, even with the modest decline in premarket trading Thursday.

"Banks will be lining up to be part of the consortium of lenders to the world's richest person," said Ives.

And even if he sold the number of Tesla shares he would need to buy all the outstanding shares of Twitter, Musk still would have a controlling stake in the company.

It's not clear if he would also try to be CEO of Twitter, especially since he is already CEO of both Tesla and SpaceX. But it's unlikely that Agrawal would continue as CEO, a role he assumed last November when Twitter co-founder Jack Dorsey suddenly stepped down as CEO.

"I don't see Musk and Agarwal sharing any candle-lit dinners," said Ives

Musk prefers privately-held companies

Musk is not a fan of having his companies publicly traded. While other private space exploration companies such as Virgin Galactic (SPCE) have gone public, SpaceX had remained privately held, despite speculation it is ripe for a public offering. And in August of 2018, he announced — on Twitter — that he was thinking of taking Tesla private, saying he thought that was its best path forward.

Musk's tweet about taking Tesla private, in which he said he had "funding secured" for the offer when he did not, got him in trouble with the SEC. He eventually had to give up the position as chairman of Tesla, and agree to have his tweets with material information about Tesla reviewed by other executives at the company.

Taking a company private, or keeping it private, reduces the oversight the watchdog agency has on its operations.

The price he suggested for Tesla at that time, $420 a share, was seen highlighting April 20, the unofficial holiday of marijuana enthusiasts. This time, Musk's $54.20 per share offer for Twitter also includes "4.20."