- calendar_month September 14, 2021

- folder Real Estate News

Sharing Tags

California, COVID-19, eviction moratorium, Homeowners, Mortgage rates, MultiFamily Homes, RE Investors, Real Estate News, Sellers

Tim Lucas The Mortgage Reports Editor

September 10, 2021 - 14 min read

Mortgage rate forecast for next week (September 12-18, 2021)

Despite Thursday’s report from the Labor Department, citing unemployment claims dropping to a new pandemic low, it looks like low mortgage rates should remain in place for the remainder of the summer.

Thursday’s jobs report was better than expected. Showing that the surge in COVID-19 cases caused by the Delta variant has yet to lead to widespread layoffs.

That said, on Thursday, September 9, Sam Khater, Freddie Mac’s Chief Economist stated, “While the economy continues to grow, it has lost momentum over the last two months due to the current wave of new COVID cases that has led to weaker employment, lower spending and declining consumer confidence.”

Therefore, we expect rates to stay in the sub-3% range for next week.

Will mortgage rates go down in September?

It seems like mortgage rates will stay in their current low range throughout September, at least until the end of the month.

Concerns around the Delta variant are still keeping rates low. And recent reports show our economic recovery slowing down.

The August jobs report — released September 3 — showed only 235,000 new jobs created in August. That was far below the forecast of 750,000 new jobs.

“The rising number of Covid-19 cases tied to the Delta variant could result in slower job growth for two reasons,” reported Wall Street Journal.

“Businesses, particularly in services sectors requiring in-person contact, could hold off on hiring amid heightened pandemic uncertainty. Jobless individuals who are fearful of Covid-19 health risks might also be slower to return to the labor market until the virus abates.”

Remember that the weaker the economy is, the longer interest rates will stay low.

Experts aren’t expecting mortgage rates to rise substantially until the Fed makes a firm announcement about when it will start tapering its bond-buying program. And, as Fed Chair Powell has said, they won’t make that announcement until they see further progress toward maximum employment. This report throws a wrench in that progress.

Further, Sam Khater, Freddie Mac’s chief economist stated, “Mortgage rates dropped early this summer and have stayed steady despite increases in inflation caused by supply and demand imbalances. The net result for housing is that these low and stable rates allow consumers more time to find the homes they are looking to purchase.”

Will we learn more about tapering plans when the FOMC meets at the end of September? And will mortgage interest rates rise as a result?

That’s yet to be seen — but it seems less likely now than it did a week ago.

For now, low mortgage rates are sticking around. And home buyers and homeowners can still save big on their housing costs.

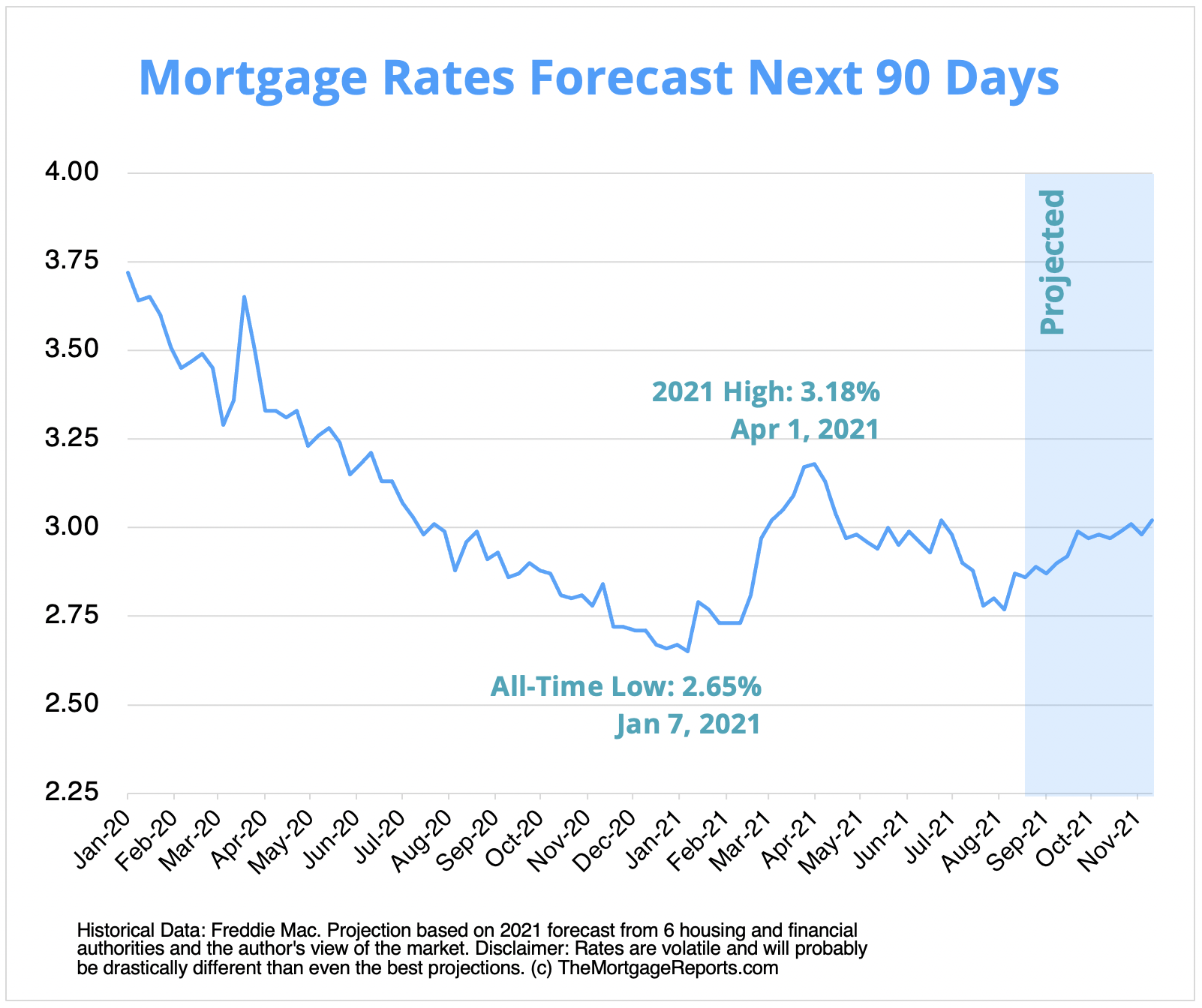

Mortgage interest rates forecast next 90 days

We expect mortgage rates to continue to hover near or just below 3% for the next few weeks. Over the next 90 days, a modest overall increase seems likely.

Based on expert mortgage rate predictions and forecasts from housing authorities, 30-year mortgage rates could go as high as 3.17% within the next 90 days.

Mortgage rate predictions for late 2021

Experts are split on their mortgage rate predictions for fall and winter of 2021.

Fannie Mae and the National Association of Home Builders see average 30-year rates staying below 3% through Q4 2021, while agencies like Freddie Mac and the Mortgage Bankers Association predict 30-year rates as high as 3.3 to 3.4% by the end of the year.

In any case, mortgage interest rates should stay in the low- to mid-3% range throughout the second half of 2021. No one is expecting a dramatic spike any time soon.

| Housing Authority | 30-Yr Mortgage Rate Prediction (Q4 2021) |

| Fannie Mae | 2.90% |

| National Assoc. of Home Builders | 2.94% |

| National Association of Realtors | 3.20% |

| Wells Fargo | 3.25% |

| Mortgage Bankers Association | 3.30% |

| Freddie Mac | 3.40% |

| Average Prediction | 3.17% |

What could cause mortgage rates to rise or fall?

Many industry experts believed rates would rise further and faster in 2021.

However, there’s a tug-of-war in the current market keeping mortgage rates low even when it seems like they should have risen.

What could drive mortgage rates up?

- An improving economy — The better the U.S. economy performs for jobs, consumer spending, and overall growth, the higher interest rates should go

- Inflation — Inflation almost always leads to higher mortgage rates, and inflation rates in 2021 have far exceeded expectations. (Although the Federal Reserve still maintains current inflation rates should be temporary)

- Real estate demand — Despite low inventory, demand for new homes and existing homes remains incredibly strong. Normally, a surge in mortgage financing should lead to higher rates

What’s keeping mortgage rates low?

- The Delta variant — Fear that the coronavirus Delta variant could stall economic growth at home and abroad is pushing mortgage rates down. Remember that weaker economies lead to lower mortgage rates

- Easy money policies by the Federal Reserve — By keeping its benchmark interest rate (the Federal Funds Rate) near 0% and continuing to purchase billions of dollars worth of mortgage-backed securities (MBS), the Fed is keeping mortgage rates artificially low

- Foreign investment in U.S. debt — Foreign investors continue to purchase relatively safe U.S. investments, including things like 10-Year Treasury bonds and MBS. An influx of dollars from these investors means continued low interest rates for borrowers

The Federal Reserve and mortgage rates

Currently, the Federal Reserve is purchasing $40 billion per month in mortgage-backed securities (MBS) as part of its Covid stimulus program.

This is one of the single biggest factors keeping mortgage rates as low as they are.

When the Fed slows or ‘tapers’ its purchasing of MBS, mortgage rates are almost certain to increase by a wider margin than we’ve seen this year.

And that could be coming in the not-too-distant future.

In a speech on August 27, Fed Chair Jerome Powell indicated that asset purchase tapering could begin before the end of the year — depending on how the Delta variant plays out economically.

Asset purchase tapering could begin before the end of the year — depending on how the Delta variant plays out economically.

“We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals,” said Powell. “My view is that the ‘substantial further progress’ test has been met for inflation. There has also been clear progress toward maximum employment.”

He continued on to say that in light of these positive trends, he and other Fed members believe it may be “appropriate to start reducing the pace of asset purchases this year.”

But — and it’s a big ‘but’ — the Fed still isn’t clear on what the overall economic impact of the Delta variant will look like. And because of that, it’s not ready to make any firm plans to start withdrawing support in 2021.

Now, all eyes are on the FOMC meeting on September 21-22.

By then we should know at least a little more about how the pandemic is impacting U.S. economic progress. And we may hear further news on tapering.

Until then, rates should stay in or near their current low range.

Current mortgage interest rate trends

Mortgage rates were up slightly this last week. The average 30-year fixed rate is 2.88%, up from 2.87% the week prior, according to Freddie Mac’s weekly rate survey.

Per the survey, 15-year fixed rates increased slightly from 2.18% to 2.19%. And the average rate for a 5/1 ARM moved slightly down from 2.43% to 2.42%.

Overall, mortgage rates are still close to their lowest levels in history.

The lowest 30-year mortgage rate ever was just 2.65%, recorded by Freddie Mac in January 2021. So anyone who can lock in at or near today’s mortgage rates is getting a fantastic deal on their home loan.

Also keep in mind that average rates are just that — averages. “Prime” borrowers with great credit and large down payments often get lower interest rates than the ones shown here. And borrowers with lower credit or fewer assets may get higher rates.

Mortgage rate trends by loan type

Many mortgage shoppers don’t realize there are different types of rates in today’s mortgage market.

But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are 3-month mortgage rate trends for the most popular types of home loans: conventional, FHA, VA, and jumbo.

| July 2021 | June 2021 | May 2021 | |

| Conforming Loan Rates | 2.99% | 3.16% | 3.15% |

| FHA Loan Rates | 3.10% | 3.23% | 3.23% |

| VA Loan Rates | 2.64% | 2.80% | 2.81% |

| Jumbo Loan Rates | 2.97% | 3.10% | 3.21% |

Source: Black Knight Originations Market Monitor Report

Which mortgage loan is best?

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high-priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits — which max out at $548,250 in most parts of the U.S.

On the other hand, if you’re a veteran or service member, a VA loan is almost always the right choice.

VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance (PMI). But you need an eligible service history to qualify.

Conforming loans and FHA loans (those backed by the Federal Housing Administration) are great low-down-payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620.

FHA loans are even more lenient about credit; home buyers can often qualify with a score of 580 or higher, and a less-than-perfect credit history might not disqualify you.

Finally, consider a USDA loan if you want to buy or refinance real estate in a rural area. USDA loans have below-market rates — similar to VA — and reduced mortgage insurance costs. The catch? You need to live in a ‘rural’ area and have moderate or low income to be USDA-eligible.

Mortgage rate strategies for September 2021

Rates seem likely to rise in September and beyond, if only marginally. But there are still great opportunities to be had for home buyers and refinancing homeowners in 2021.

Here are just a few strategies to keep in mind if you’re mortgage shopping in the next few months.

Cash-out equity at today’s low rates

Between Q1 2020 and Q1 2021, the average mortgaged household saw its equity increase by nearly 20 percent.

That translates to a lot of pent-up wealth for American homeowners.

In fact, data firm Black Knight estimates that the average U.S. homeowner now has $153,000 in “tappable” home equity. (That’s the amount that could be withdrawn before reaching the maximum LTV on a cash-out refinance.)

The average U.S. homeowner currently has around $153,000 in “tappable” home equity.

When used wisely, that equity can help improve your overall financial health and even generate new cash flows.

For example, many borrowers use cash-out funds to:

- Buy a second home or investment property

- Pay off high-interest credit card or personal loan debt

- Invest in renovations that increase their home’s value

- Invest in stocks, bonds, and other vehicles

As an added benefit, mortgage rates are still near record lows. That means some homeowners can cash-out their equity and lower their interest rate at the same time.

Wondering if a cash-out refi is worth it for you? Explore today’s cash-out refinance rates or check your eligibility via the link below.

Should you put 20% down on a house?

In a competitive real estate market, many first-time home buyers feel pressure to put down 20% or more. But that might not always be the best move.

Yes, there are benefits to making a big down payment on your home purchase.

In terms of cost, you’ll likely get a lower mortgage rate. And your monthly payments will be reduced because you’re borrowing less.

But there are downsides to a 20% down payment, too.

If making a big down payment would drain your savings — leaving you with little cash for things like repairs, furnishing, and an emergency fund — then it’s likely not wise to pay so much out of pocket.

Not to mention, if you’re waiting until you have 20% down to buy, you might be waiting a long time. Home values are rising quickly nationwide — which means the longer you spend saving, the higher home prices you’ll be chasing.

To learn more and explore low-down-payment options, check out this article on the pros and cons of a 20% down payment.

Or, listen to our home buying podcast on Apple Podcasts or Spotify.

Save more by shopping around

Mortgage lenders are still offering near-record low rates to good borrowers. But there’s a catch.

You can’t just look for the lowest rate advertised online. Because the rates lenders advertise aren’t available to everyone.

Those offers typically represent borrowers with perfect credit, 20% down or more, and a sterling credit history.

Those criteria won’t apply to everyone. The rate you’re actually offered depends on:

- Your credit score and credit history

- Your personal finances

- Your down payment (if buying a home)

- Your home equity (if refinancing)

- Your loan-to-value ratio (LTV)

- Your debt-to-income ratio (DTI)

To figure out what rate a lender can offer you based on those factors, you have to fill out a loan application. Lenders will check your credit and verify your income and debts, then give you a ‘real’ rate quote based on your financial situation.

You should get 3-5 of these quotes at minimum. Then compare them to find the best offer.

Look for the lowest rate, but also pay attention to your annual percentage rate (APR), estimated closing costs, and ‘discount points’ — extra fees charged upfront to lower your rate.

This might sound like a lot of work. But you can shop for mortgage rates in under a day if you put your mind to it. And shaving just a few basis points off your rate can save you thousands.

Mortgage interest rate FAQ

What are current mortgage rates?

Current mortgage rates are averaging 2.88 percent for a 30-year fixed-rate loan, 2.19 percent for a 15-year fixed-rate loan, and 2.42 percent for a 5/1 adjustable-rate mortgage, according to Freddie Mac’s latest weekly rate survey. Your own rate could be higher or lower than average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Will mortgage rates go down next week?

Mortgage rates should stay about flat next week (September 5-11). We aren’t expecting any big rate movements until — possibly — the end of September, when the FOMC has its next policy meeting and may announce more definite plans for asset purchase tapering within the year. (Translated: Mortgage rates could go up toward the end of the month.)

Are mortgage rates expected to drop in 2021?

Mortgage rates are not expected to drop by any significant amount in the remainder of 2021. However, if the Covid cases continue to worsen due to the Delta variant, this could drag down the U.S.’s economic recovery. Any significant slowdown could push mortgage rates lower, or at least help to keep them in the sub-3 percent range throughout the fall.

Will mortgage interest rates go up in 2021?

Yes, mortgage rates are likely to increase in 2021 and next year. Most economists and housing authorities are predicting rates in the low- to mid-3 percent range by the end of the year, rather than in the high 2s where they’ve been recently. However, due to economic uncertainty caused by the Covid-19 Delta variant, significant rate increases may not come until the end of the year.

What is the lowest mortgage rate right now?

Freddie Mac is still citing average 30-year rates below 3 percent. But remember that rates vary a lot by borrower. Those with perfect credit and large down payments may see lower rates in the 2 percent range, while poor-credit borrowers and those with non-QM loans might see interest rates closer to 4 percent. You’ll need to get pre-approved for a mortgage to know your exact rate.

Will mortgage rates go up with inflation?

In a normal market, inflation leads to higher mortgage rates. Fixed-rate assets like mortgage-backed securities (MBS) have to offer bigger returns to entice investors when inflation is rising. However, we’re not in a normal market. The Fed believes current inflation rates will be temporary, which is helping keep mortgage rates low. And economic concerns over coronavirus are pushing rates down as well. So they haven’t responded to inflationary pressures as usual.

What is the lowest mortgage rate ever?

At the time of this writing, the lowest 30-year mortgage rate ever was 2.65 percent. That’s according to Freddie Mac’s Primary Mortgage Market Survey, the most widely-used benchmark for current mortgage interest rates.

What’s a good mortgage rate?

Any mortgage rate in the low- to mid-3 percent range is very good by historical standards. Looking back just one year, mortgage rates started 2020 at nearly 4 percent. And they were above 4.5 percent in early 2019. So today’s rates are excellent by comparison.

Is now a good time to refinance?

That depends on your situation. It’s a good time to refinance if your current mortgage rate is above market rates and you could lower your monthly mortgage payment. It might also be good to refinance if you can switch from an adjustable-rate mortgage to a low fixed-rate mortgage; refinance to get rid of FHA mortgage insurance; or switch to a short-term 10- or 15-year mortgage to pay off your loan early.

Is it worth refinancing for 1 percent?

It’s often worth refinancing for 1 percentage point, as this can yield significant savings on your mortgage payments and total interest payments. Just make sure your refinance savings justify your closing costs. You can use a mortgage calculator or speak with a loan officer to crunch the numbers.

What will mortgage rates be in 5 years?

Based on what we know today, it seems likely mortgage rates could be higher in 5 years than they are now. Current mortgage rates are near their lowest levels ever, and seem more likely to rise than to drop further. However, any number of unexpected events could change the course of interest rates in the next few years. For instance, no one predicted the Covid pandemic would push mortgage rates to new record lows in 2020 and 2021.

How do I shop for mortgage rates?

Start by choosing a list of 3-5 mortgage lenders that you’re interested in. Look for lenders with low advertised rates, great customer service scores, and recommendations from friends, family, or a real estate agent. Then get pre-approved by those lenders to see what rates and fees they can offer you. Compare your offers (‘Loan Estimates’) to find the best overall deal for the loan type you want.

Should I lock my mortgage rate today?

Refinancers: If you’ve compared loan offers and you’re confident you’ve found the best deal, today is a great time to lock a mortgage refinance rate. Home buyers: If you have a signed purchase agreement and loan approval in hand, today is also a great time for you to find a low rate and lock in.