- calendar_month August 9, 2021

- folder Real Estate News

ERIK J. MARTIN BANKRATE.COM

UPDATED AUGUST 05, 2021 11:18 AM

The dog days of summer have officially arrived. But while temperatures are likely to soar higher across much of the country in the coming weeks, mortgage interest rates probably won’t. That’s good news for many buyer candidates and homeowners seeking a purchase loan or refi, of course.

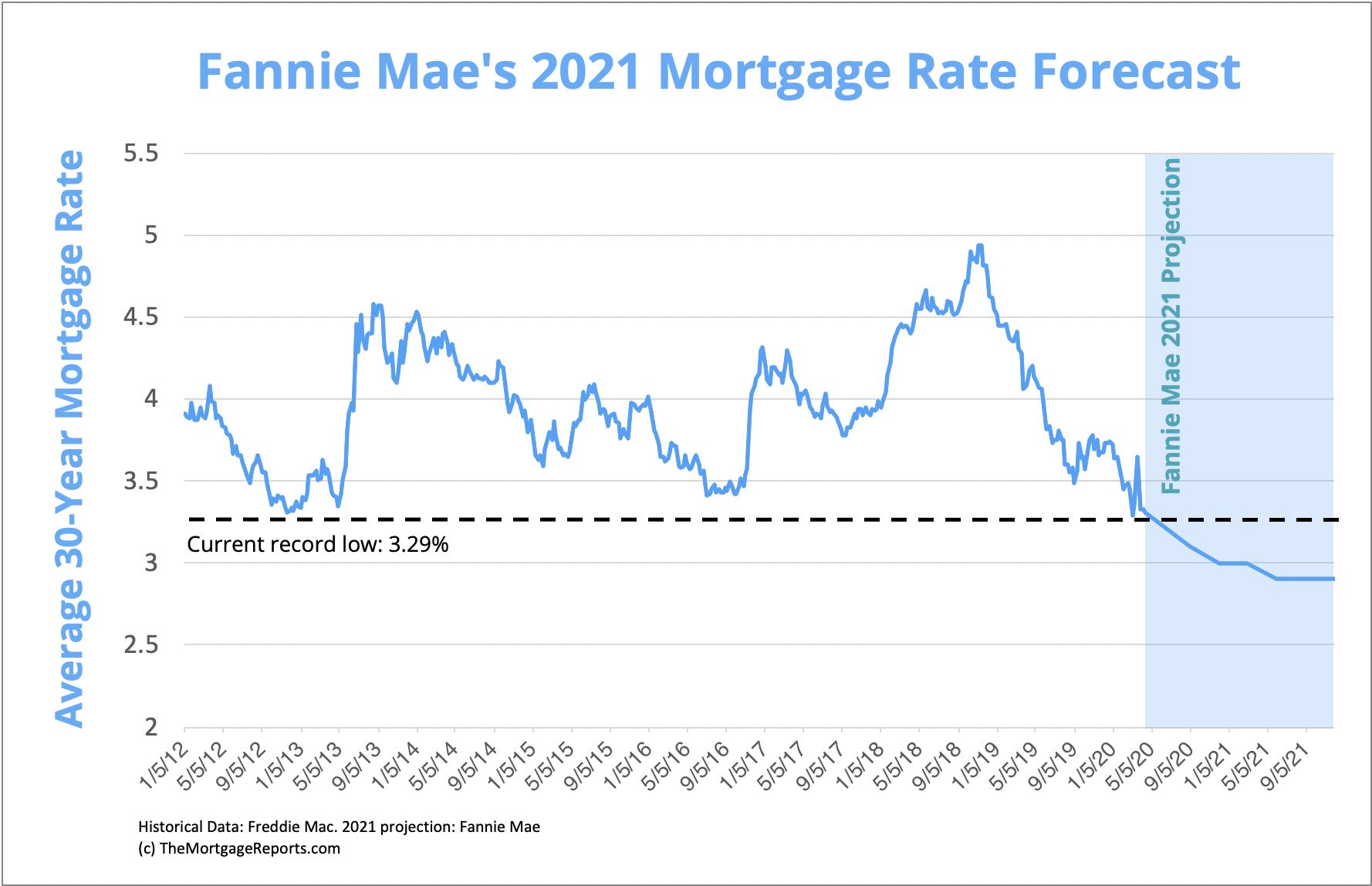

Mortgage rates remain near historic lows, dropping recently to their lowest levels since last winter. The benchmark 30-year fixed-rate mortgage hovered at 3 percent near the end of July, and 15-year fixed rates were around 2.3 percent.

As is the case with weather, things can change quickly for better or worse. So what’s a mortgage-seeker’s best strategy — lock in now or see where rates stand several calendar pages away? That will depend on your goals, timetable and financial outlook.

Mortgage rate outlook for August

Rates took a surprising move downward in July, which got a lot of would-be borrowers excited. Many were also jazzed that the Federal Housing Finance Agency (FHFA) did away with the 0.5 percent fee on refinances for Fannie Mae and Freddie Mac loans, effective August 1. Will these low rates be with us much longer?

“Mortgage rates are more likely to rise in the following months. Nevertheless, don’t expect any sharp spikes in August,” Nadia Evangelou, senior economist and director of forecasting for the National Association of Realtors in Washington, D.C., says. “I expect mortgage rates to show little change in August, hovering around 3 percent as most economic indicators will start to normalize.”

Chuck Biskobing, a senior real estate attorney with Atlanta-based Cook & James, agrees.

“I expect rates to more or less hold steady for the next month in the 3 percent range for a 30-year mortgage. Given recent unexpectedly high jobless claims, I think a major move upward in rates is unlikely,” he notes. “Monthly inflation numbers are a bit of a wildcard, but overall I think rates will remain around current levels for the time being.”

Indeed, inflation and economic growth are the variables most at play right now, says Greg McBride, chief financial analyst for Bankrate.

“Ironically, they have both led to lower long-term rates. However, any hints of tapering bond purchases from the Federal Reserve would push mortgage rates up this month,” McBride adds. “How the debate about whether inflation is transitory or more sustained ends up being resolved is not yet known. But if these temporary factors yield to evidence that indicates higher inflation is embedded, we’ll see rates jump.”

George Raitu, senior economist for Realtor.com, said in a recent statement that homebuyers “remain boxed-in by high prices, tight inventory and escalating inflation, which is taking a bigger bite out of their monthly paychecks. At today’s rate, the monthly mortgage payment for a median-priced home is $109 higher than the same time in 2020.”

Rates for fall 2021 and beyond

Industry experts predict a few major fluctuations in mortgage interest rates between today and the end of the year. Fannie Mae foresees the 30-year fixed-rate mortgage averaging 3 percent by late 2021, close to Freddie Mac’s prediction of 3.1 percent. The Mortgage Bankers Association foresees a 3.4 percent average rate across the year, once 2021 draws to a close.

“Modestly higher mortgage rates are the most likely outcome, particularly as the persistence of inflation becomes a greater concern. But the good news is that mortgage rates in the low 3’s, on average, and below 3 percent for those shopping around, will still prevail,” says McBride.

If we do see continued inflation, the Fed may be forced to pull back on asset purchase programs and rates could jump faster than expected, Biskobing cautions.

“However, I think there’s a good chance the inflation we’ve been seeing is tied closely to supply chain issues related to COVID shutdowns. I think these issues should resolve themselves over the next few months. Nevertheless, I think the 30-year mortgage rate will trend higher and may approach 3.5 percent by year-end,” he says.

That’s exactly the New Year’s number Evangelou imagines rates landing at, too.

“While jobs are coming back strongly, we are also seeing many university campuses preparing to welcome back students in the fall. Thus, millions of students will look for a home soon, even further increasing the demand for rental homes,” she says. “Remember that rents are a major component of the inflation rate, representing more than 40 percent of core inflation.”

Slowing vaccination progress and increasing coronavirus numbers may tip rates a bit lower in future months, too.

“Concerns about rising Delta variant cases could drift down both 10-year Treasury yields and mortgage rates,” says Evangelou. The Treasury rate and mortgage rates track each other closely.

On the other hand, additional spending from Congress could lead to higher mortgage rates as the market bids up rates in advance of any Fed move.

“Congressional infrastructure spending will add fuel to the fire of inflation, but whether it is enough to force the Fed to act is yet to be seen,” Biskobing says.

Now’s the time to get a mortgage

Now is a fantastic time to take advantage of comparatively low mortgage rates. Problem is, can your wallet withstand the monthly payments required to afford the average home asking price?

“Many first-time buyers are being priced out, despite these historically low rates. While inventory is especially limited in the price range of a starter home — $270,500 — the affordability gap between first-time purchasers and all buyers is 34 percent, making it even more difficult for them to purchase a home,” says Evangelou.

Biskobing and says there are no easy answers for many.

“Purchasing a home right now is a tough choice. Rates are likely going to move higher in the future, so getting a cheap mortgage now seems to make sense. Still, home prices are at or near all-time highs, and building costs are still elevated,” he says. “The question becomes, do you want to wait for home prices and material costs to come down, which risks getting a higher-rate mortgage, or do you want to lock in now and not worry so much about purchase price?”

When it comes to a refi, however, experts give the green light.

“The golden refinancing opportunity has stuck around much longer than expected, but don’t tempt fate. Lock in a sub-three percent fixed rate while you can,” says McBride. “Reducing mortgage payments in a meaningful way is especially valuable with the cost of so many other items in the household budget on the rise.”